Disclaimer: PropStream does not offer investment advice. Our posts are for informational purposes only. We recommend working with a legal or accounting professional before signing any real estate contracts or taking on any new investments. While data can offer insight into the potential of a rental property, users should always use discretion to ensure decisions are suitable for the current market.

In today’s unpredictable market, finding your next rental property can be a challenge; however, it’s still very possible with the right strategy and tools.

To ensure you’re making the most educated investment decisions in any market, you need a tool like PropStream in your back pocket. PropStream allows you to find the best deals with the most potential, so you can continue investing in even the murkiest of markets.

So, what exactly does PropStream offer to help guide your rental property search? We went over some of our top tools and filters to help you find rental property leads. Keep reading to learn more!

Gross Yield

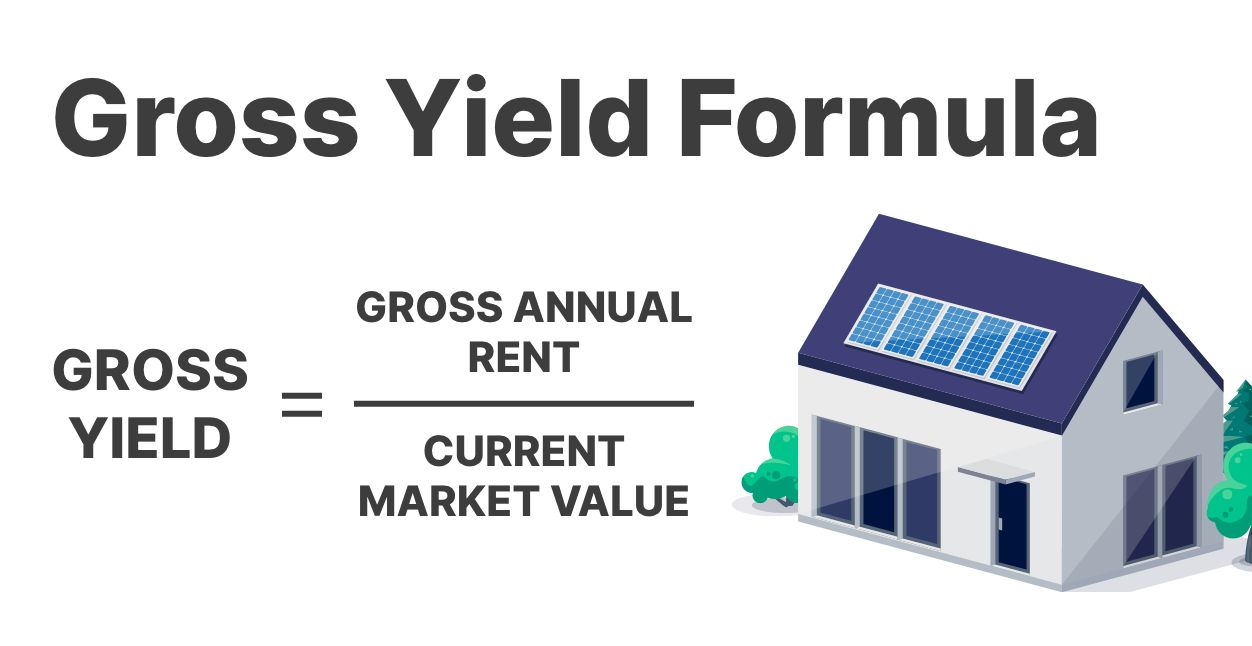

If you’re unfamiliar with the term, Gross Yield refers to the overall return on an investment (not including taxes or deductions).

For a buy and hold real estate investor, Gross Yield offers insight into what a rental property can potentially make in a year. To help you easily uncover properties with a specific Gross Yield percentage, PropStream offers a “Gross Yield” filter. The formula we use for Gross Yield is Gross Annual Rent/Current Market Value.

When using our Gross Yield filter, we recommend targeting 5% or higher. Why? Because this percentage suggests that you can potentially expect a 5% return or more in your first year of renting out the property.

If you can find a property with a higher Gross Yield percentage than 5%, that’s even better. However, 5% is a fairly conservative number to aim for if you want to have various investment options. A 5% Gross Yield for real estate is similar to what you’d look for if you were to invest in another asset, like stocks.

Ensuring you’re aiming for a high enough Gross Yield is important because if you were to target a property with a lower percentage of around 2%, this might not be considered a good investment. With a lower return, you may find your profits taken up by operating costs, like renovations, property taxes, property management fees, etc.

Gross Yield is especially important in the current real estate market, as inflation rates have risen to over 6% for a 30-year mortgage. Failing to look into the earning potential of a property and accounting for monthly expenses combined with higher interest rates can eat into your profit, potentially causing you to earn a negative cash flow rather than a positive one.

Example:

Say you have your eye on a property with an estimated value of about $673,000. If you determine you’ll need a Gross Yield of at least 5%, you can estimate that you’ll need to charge at least $2,900 per month.

Now, if you can get a deal on the property because it’s distressed or the owner needs to sell urgently (more on how to find motivated sellers later), you may be able to have an even higher Gross Yield than you originally predicted. Since you’re paying less than the estimated value while still charging that $2,900 or more per month, you may increase that positive cash flow margin.

Tip: With talks of recent job cuts in the tech sectors and mortgage industry, there are rumors of a recession looming. Historically, recessions have impacted rental prices (forcing rent prices down). With this information, be sure to consider a worst-case scenario and ensure your Gross Yield is at a rate that suits your overall investment strategy.

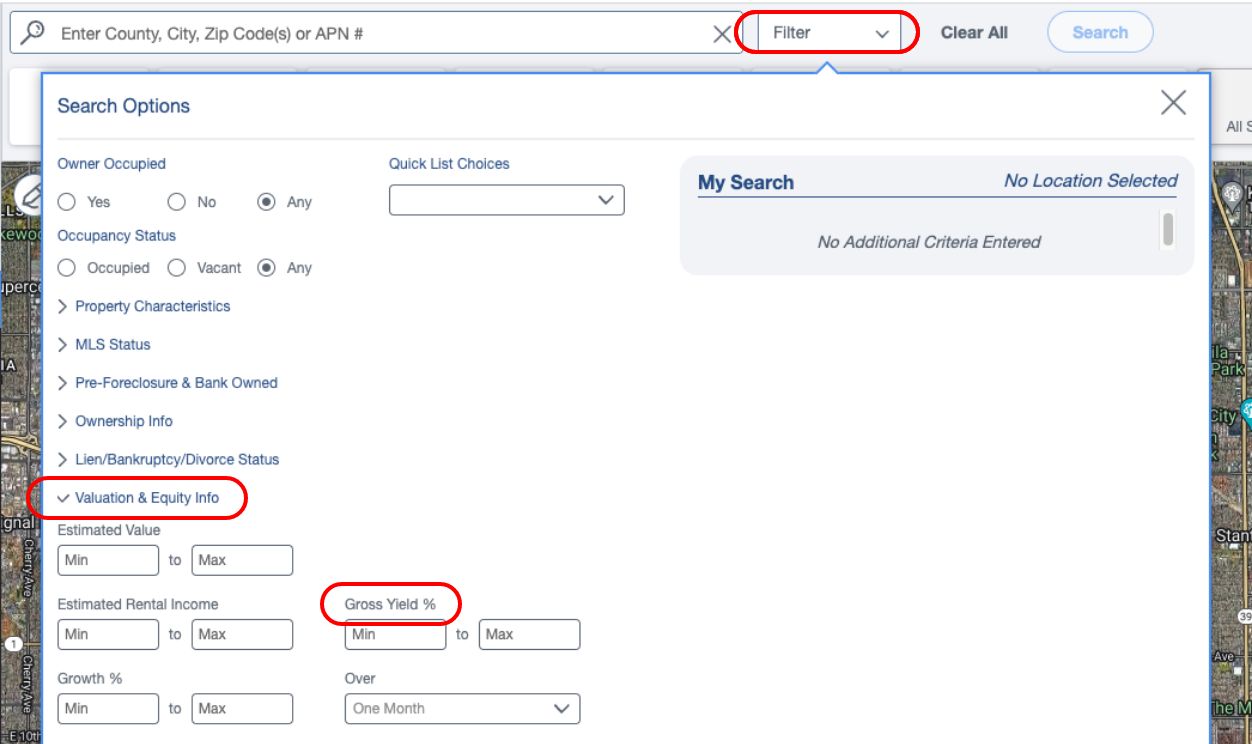

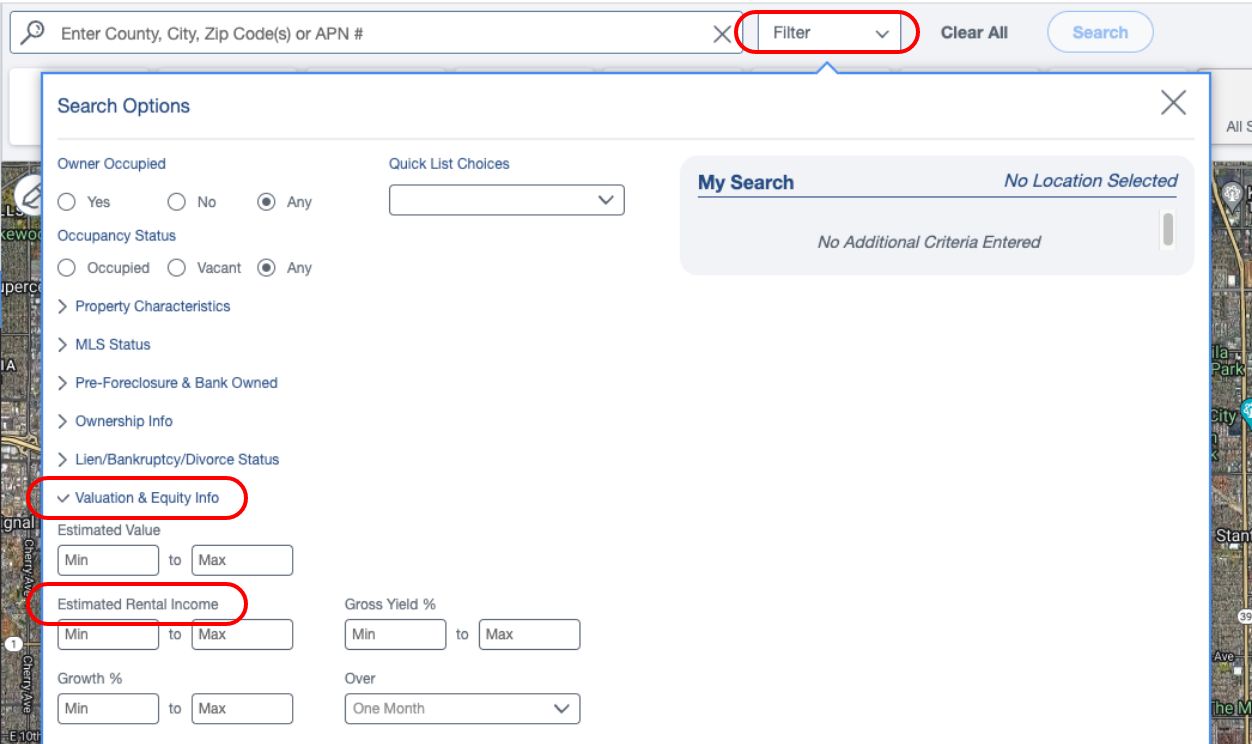

Where Can You Find the Gross Yield Filter in PropStream?

The Gross Yield filter is located under the “Valuation & Equity Info” tab under the “Filter” dropdown.

Under that tab, you can add a minimum and a maximum Gross Yield percentage. If you’re looking for a property in a certain price range, you can also specify a minimum and maximum estimated value in this section as well.

Estimated Rental Income

Where our Gross Yield filter uses a formula (Gross Annual Rent/Current Market Value) to determine a potential return percentage, our Estimated Rental Income filter is used to find properties that could be rented out for a specified amount each month.

Many seasoned investors with a strong understanding of their local market prefer to search by Estimated Rental Income, since they have enough experience to determine a rough Gross Yield percentage themselves. For example, if you’re an experienced investor and you know that the average price of a property in your region is around $600,000-700,000 and the average rent is around $3,000-3,500 monthly, you may be able to determine that this combination can produce a return of 5% or more.

In this case, when searching on PropStream, you may look for properties in that price range while entering an Estimated Rental Income of $3,000-3,500 per month.

Tip: If you’re newer to investing in rental properties, you may find it easier to use our Gross Yield filter rather than the Estimated Rental Income filter. This is because the Gross Yield filter does the work for you in estimating a potential return.

Where Can You Find the Rental Amount Filter in PropStream?

To search by rental amount, click the dropdown for the “Valuation & Equity Info” tab (the same place you found Gross Yield).

To search by rental amount, click the dropdown for the “Valuation & Equity Info” tab (the same place you found Gross Yield).

Under this tab, you’ll see an “Estimated Rental Income” section. There, you can add a minimum and maximum rental amount you’d like to target.

Growth %

If you’d rather target properties based on a set growth rate over time, we recommend our Growth % filter.

To ensure you’re finding properties with enough growth rate to be considered a good investment, we recommend a growth percentage of at least 3.5% over 12 months. We recommend these numbers because a more conservative or modest number (like 3.5-5%) can indicate steady, continuous growth. If you target properties with incredibly high growth rates (like 10-12%), you may find that rate was just a temporary trend, and eventually, it may come down.

With real estate investing, your goal is to have the most reliable investment possible and always generate profit from the rental properties you own. Even if the property currently supports a profit after necessary expenses and fees, you’ll want to make sure as expenses inevitably rise over time, your property’s potential profit rises with it.

Important: Growth % is a formula PropStream uses based on historical trends for that property. In a stable market, these numbers can be very accurate. However, in a more volatile market like the one we’re seeing today, growth rate percentages may be harder to predict. When using real estate data to guide your investing decisions, we recommend always using caution and still getting to know your local market.

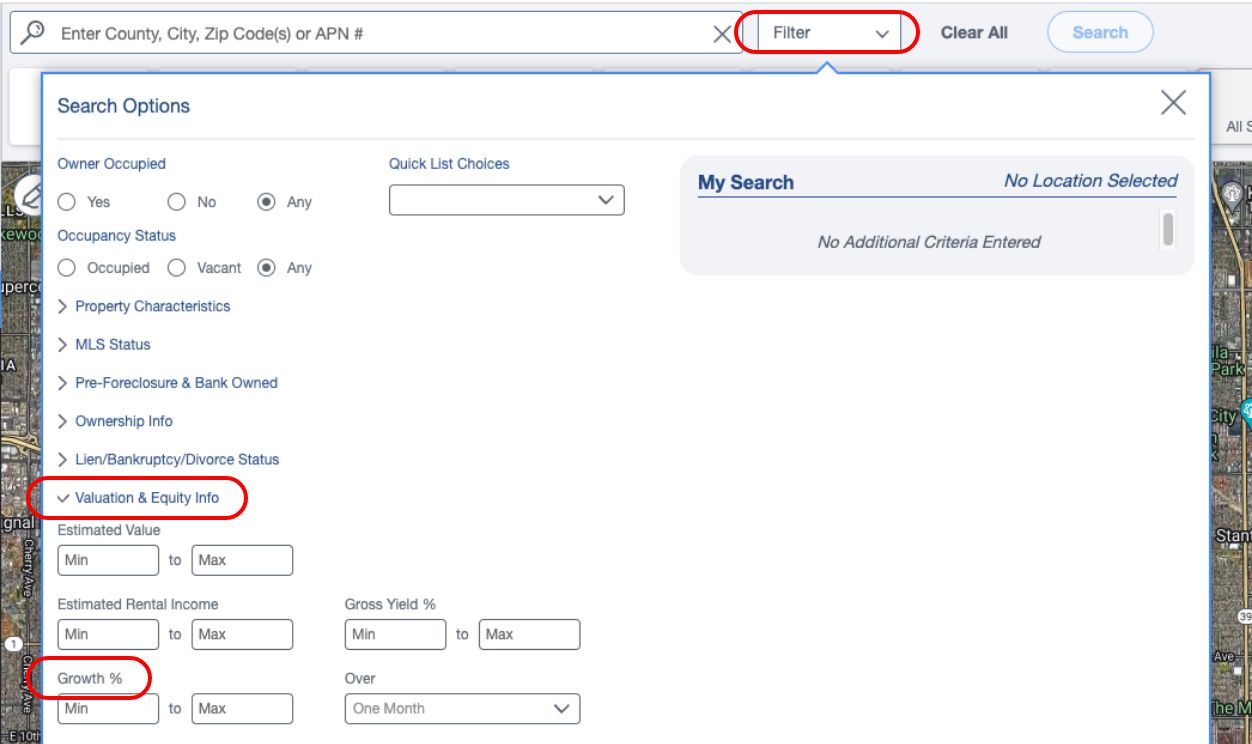

Where Can You Find the Growth % Filter in PropStream?

As with Gross Yield and Estimated Rental Income, you can find the Growth % filter under the “Valuation & Equity Info” tab.

There, add a minimum and maximum growth percentage and a set period you’d like to study data for.

If you want to review this data visually, check out our Heat Map (more info below).

On-Market Vs. Off-Market and Using Filters to Find a Rental

Part of your rental property hunt includes choosing between on-market and off-market properties.

Both property types have pros and cons and will be more suitable depending on your budget and business model. If you’re looking for a rental property that’s already updated and ready for a tenant to move in, and you don’t mind paying more for it, you may opt for a property that’s already on the market.

Since these homeowners are planning to sell for top dollar, they’ve likely taken the steps to address necessary repairs and add cosmetic updates. Keep in mind, that if you choose to purchase a property that is currently on the market, you may end up paying significantly more than you would normally, as housing prices are still inflated, and interest rates are now higher as well.

If you don’t mind taking on a fixer-upper and you want to make the lowest possible upfront investment, you may find off-market properties to be a better option. If you run comps and find an off-market lead in a neighborhood or region with great potential, you may be able to create an even larger profit margin since you’re getting a better deal.

PropStream makes finding the best off-market deals quicker and easier, as we have specialized filters and Lead Lists that signify which homeowners are more likely to sell.

Searching Off the Market With PropStream

When targeting an off-market property, it’s important to be strategic with whom you reach out to if you want to save money and time marketing to your prospects.

For example, you wouldn’t want to target an off-market property with a homeowner who just bought 1-2 years ago and who has no apparent signs of financial difficulty. Additionally, someone in a healthy financial situation who took out their mortgage when interest rates were lower may not be interested in purchasing a new home with higher interest rates either.

Instead, you’ll want to target homeowners who are in challenging financial situations or who have no use for their property. With PropStream, you can find these homeowner types by applying these Lead Lists:

- Pre-foreclosure

- Divorce

- Bankruptcy

- Liens

- Tax Delinquencies

- Failed Listings

And more!

With inflation making the cost of goods much more expensive, many homeowners who are already experiencing financial hardship may be pushed to eliminate what is likely their largest monthly payment: their mortgage.

Want to target your search even more? We have additional filters that offer insight into equity, property taxes, property features, and more to help you find the most qualified leads.

Pro Tip: With PropStream, you can organize your leads into marketing lists based on selling motivation, neighborhood, estimated value, or any other criteria you choose. Once lists are created, you can easily send a postcard or email campaign catered to that list.

Using Heat Maps to Find Rental Properties

If you’re more of a visual learner, our Heat Map is a great tool for gaining insight into the potential of a rental property.

When using the Heat Map for finding rental properties, you may find the Price Growth and Rental Values tabs to be the most helpful.

Price Growth

As we mentioned earlier with the Growth % filter, investors planning on holding their properties for several years typically want to ensure that a new property will have stable growth.

With the Price Growth tab, you can find historical price growth trends for an entire region, like a neighborhood, to determine if looking in that region is worth your time. Under the Price Growth tab, you can also select a range of time frames to study the growth for that region. We recommend utilizing the 3-year and 5-year options to study longer-term historical growth trends if you plan on holding for years.

While this map can’t guarantee future price growth in a specific region, it does offer insight into which areas have been steadily growing in price value for several years. This knowledge is helpful should you decide to sell a property and upgrade, as you can feel more confident with the likelihood of getting a larger return with the sale.

Rental Values

Additionally, with the Heat Map, you can uncover rental value trends for certain regions. This can help you discover which regions have average rental prices in your desired range.

Among the rental value datasets are:

- Rent

- Rent Price

- Rent Price/Bedroom

- Rent Price/Sq. Ft

This information is especially helpful for finding the best opportunities in the current real estate market. If you can get a deal on an off-market property in an area with great rental potential, you may be able to renovate the property and charge more per month, increasing your monthly cash flow.

Since your initial investment is lower and you can borrow less to secure the property, your monthly payment may be lower while still allowing you to charge a rental price comparable with other local rental properties.

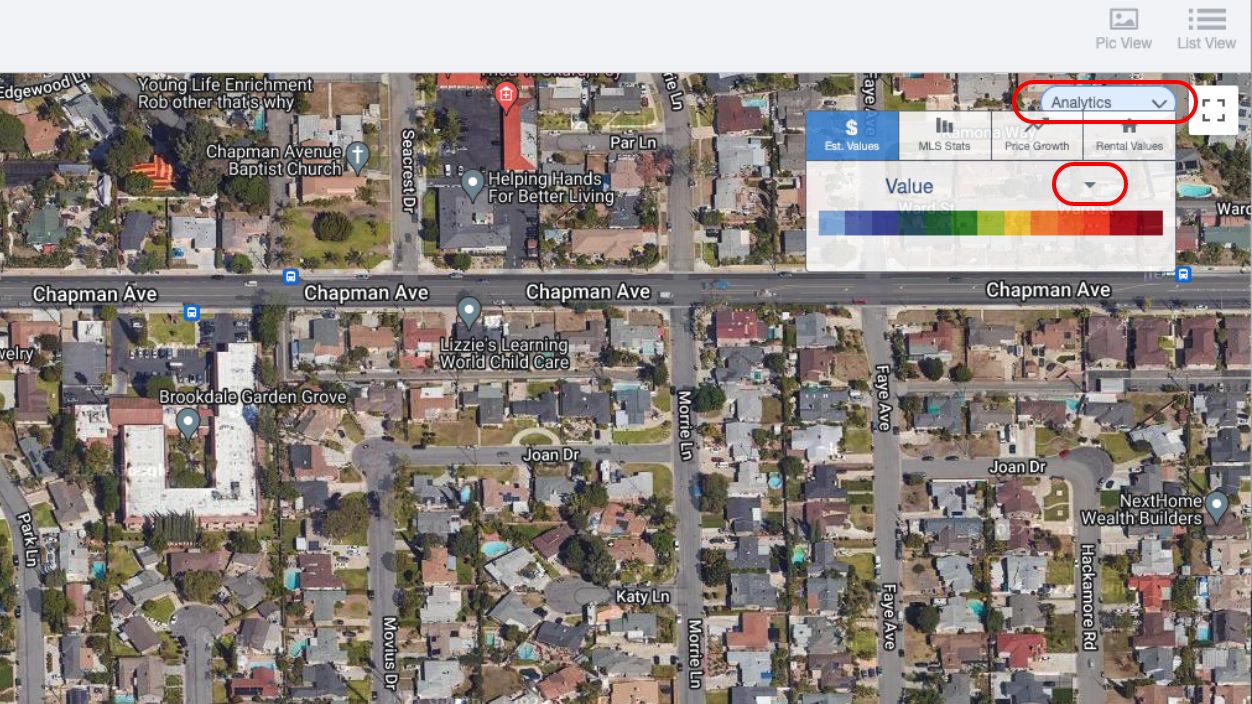

Where Can You Find the Heat Map in PropStream?

When you’re looking at the Google Maps view of a region in PropStream, you’ll notice an “Analytics” button in the upper right corner.

Click on this button, and you’ll see a dropdown with the “Price Growth” and “Rental Values” tabs. From there, you can customize your search by choosing the additional Heat Map filters we mentioned above.

Are You Ready to Start Finding Rental Opportunities With PropStream?

While the current market is a little harder to navigate than you may be used to, with a little extra research, the right tools at your disposal, and careful planning, you can continue expanding your portfolio with excellent rental opportunities.

To start using the search filters and features we discussed to find your next rental property, try PropStream for 7-days free! Or, to learn more about how to use these filters, check out our free PropStream Academy course: Finding and Buying Rental Properties: The Road to Passive Income.